Tom Gockelen-Kozlowski looks into the trend of functional and protein products, and how to make the most of this fast-growing, but highly complex category

From the preserve of muscle-bound gym-goers to finding a place in every trade show going, we all know the protein market has exploded in recent years.

But if you’ve already built up a picture of the typical protein product shopper, forget it. Suppliers and wholesalers are in agreement that the protein category has become more complex, more widespread and more essential to the ranges that both wholesalers and convenience stores offer.

“I think protein represents two slightly different aspects,” says Ben McKechnie, managing director of Epicurium, a specialist wholesaler that focuses on healthier snacks. “Yes, it serves the image-conscious ‘Love Islanders’ whose focus is on looking good, going to the gym and being seen eating protein as part of the gym-goer image.

“Importantly, it also serves health-conscious consumers with its ‘fuller for longer’ properties, meaning it is part of a healthy diet and aids a consumer’s appetite control.”

McKechnie believes understanding this widening of demand is key to finding success in this category: “Both are part of the healthy snacking phenomenon, but are driven by slightly different needs.”

Understanding the protein product market

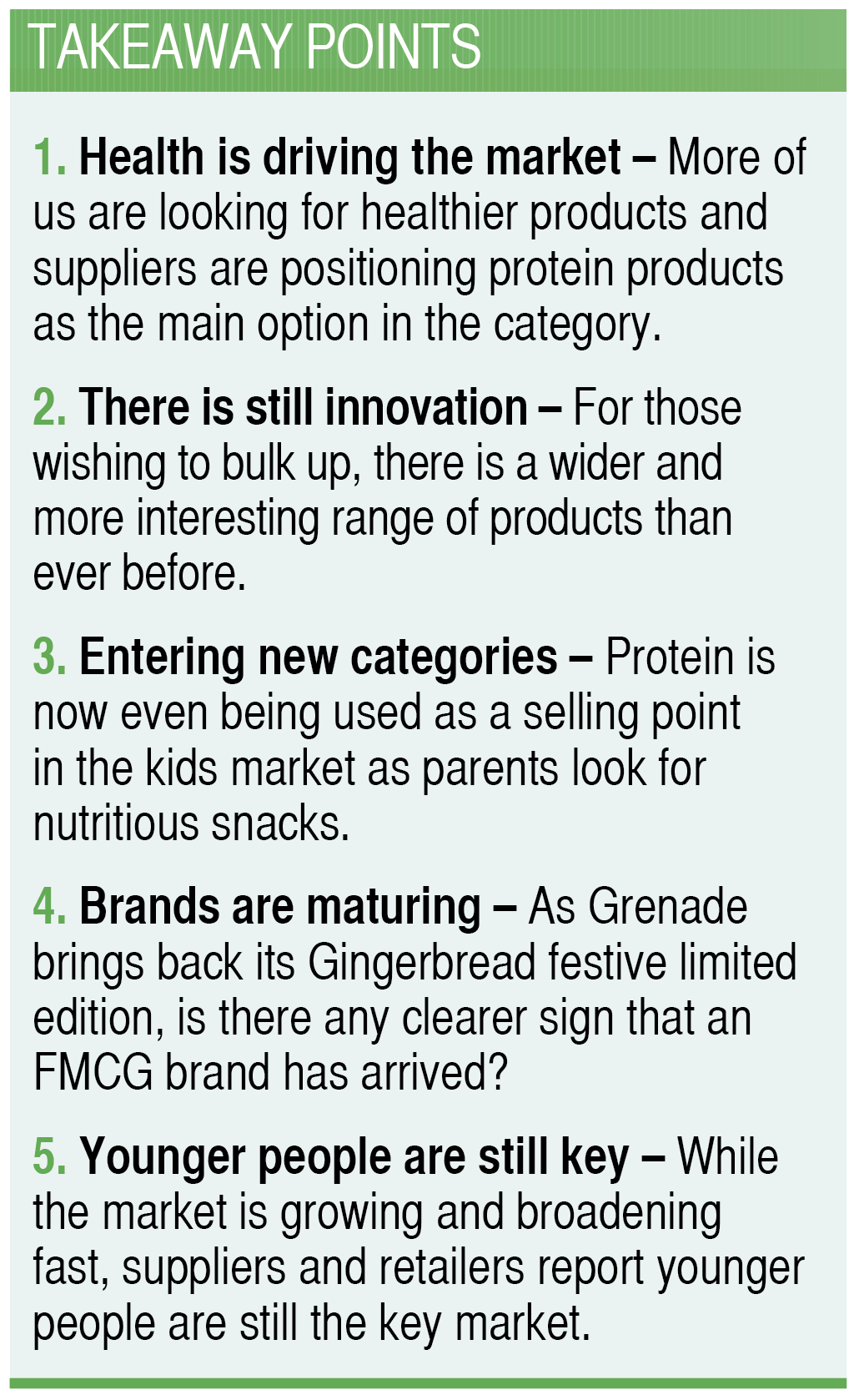

A look at the market clearly proves McKechnie’s point – brands are increasingly positioning themselves away from the specialist market and towards general healthier living trend. The fact that industry data shows that nearly a third of snacks are chosen on the basis of health shows this is definitely not a niche opportunity.

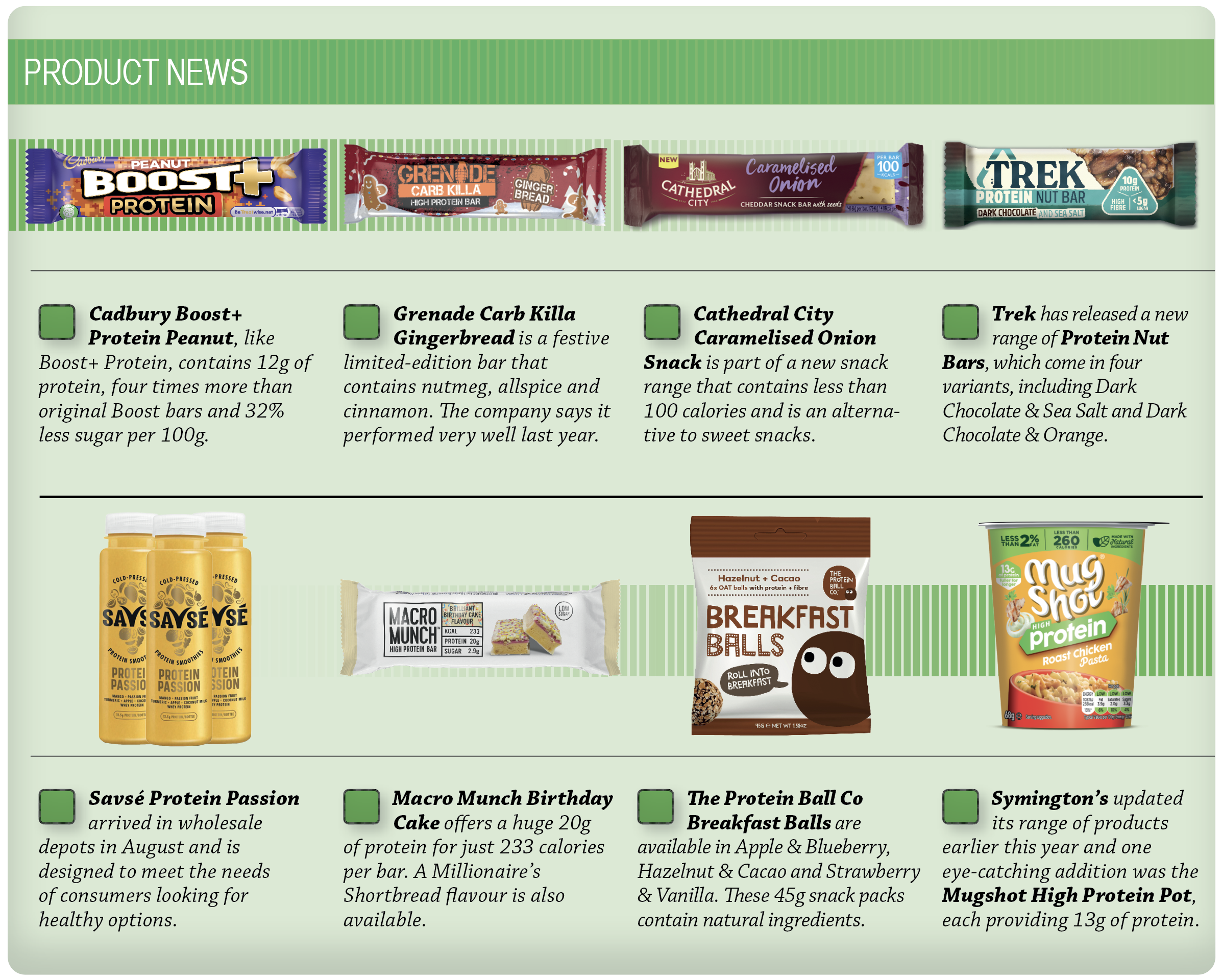

Many launches still clearly highlight the protein boosts they offer, but the brands behind them appear increasingly aware of this changing demand and consumer behaviour.

“Consumers are more conscious than ever before of what they’re putting in their bodies,” says Paul Gurnell, chief executive of soft drinks brand Savsé.

The company recently updated its protein smoothie range with the launch of Protein Passion.

While the company highlights its key market as those shoppers between 25 and late-30s, Gurnell says the company has formulated the new product specifically to widen the protein market to those consumers looking to live healthier lives.

“The majority of other protein drinks on the market offer an extremely high level of protein content – around 20g – which is only really useful for those people focusing on extreme exercise. Protein Passion and our existing Protein Punch range have 10-12g of protein to attract consumers simply looking to lead a healthier lifestyle,” he says.

Wider appeal

Trek is one of a number of healthier snack brands aiming for a wider appeal. Its marketing director, Marina Lovell-Smith, highlights the “healthy, natural energy hit” the company’s protein products provide, emphasising their relevance to consumers looking for “post-gym nourishment”.

Yet, her messaging regarding Trek’s new range of Protein Nut Bars – that they “satisfy consumers driven by hunger” – backs up McKechnie’s comments that the protein market is now also catering to different needs and customers.

That Trek’s new range is promoted as a vegan option, meanwhile, is a sign that consumers are becoming more demanding of this now-ubiquitous sector.

As the protein market goes mainstream, it is joining forces with another area of the market – one also looking to cater for shoppers who simply need an energy boost during their busy days: functional drinks.

Red Bull’s latest innovation – as part of its Editions series – is a Coconut & Berry flavour, formulated to overcome the major barrier to trial in the category, which the firm says is “taste”.

Its latest marketing campaign – Project Pro – which links the company with a number of professional sports people and encourages consumers to “unleash their inner athlete”, highlights a blurring of the lines between the protein and functional drinks trends – both of which originate with sport and exercise.

Retailer viewpoints

“We have a section in our queue full of protein bars and snacks, and we also stock Grenade drinks. Six months ago, you could sell anything with protein on the label. It’s plateaued now, but I wouldn’t scale back the space we give it – there is an expectation stores will have protein products.”

“We have a section in our queue full of protein bars and snacks, and we also stock Grenade drinks. Six months ago, you could sell anything with protein on the label. It’s plateaued now, but I wouldn’t scale back the space we give it – there is an expectation stores will have protein products.”

Justin Taylor, Spar Winford, Littleton Mills

“Protein isn’t just for people going to the gym – for a lot of people, a protein product ticks a box just like going for a run would. We have a range of Grenade, Boost+ Protein and other bars, and we also have a range of drinks such as the Savsé brand, which has just released a new Protein Passion flavour.”

“Protein isn’t just for people going to the gym – for a lot of people, a protein product ticks a box just like going for a run would. We have a range of Grenade, Boost+ Protein and other bars, and we also have a range of drinks such as the Savsé brand, which has just released a new Protein Passion flavour.”

Dean Holborn, Holborn’s, Redhill

“We stocked a range of protein products for two months or so, but they were too expensive. I tried them because I know they are all the rage, but when you have a £2.50 bar next to an 80p one, my elderly customers will always choose the latter, as the massive price difference is obviously a major factor for that type of customer.”

Adrian Rodda, AR News, Harrogate

“We do extremely well with Grenade and actually stock 12 types. We sell quite a lot of £2.49 bars per week. We also stock Special K, Mars, Graze and other bars, too. We tried protein cereals and yoghurts, but the rate of sale was too slow, so we decided to stop selling those types of products.”

Sid Sidhu, St John’s Budgens, Kenilworth

Unexpected areas

The protein category continues to enter into new and unexpected markets. One area is the market of just-add-water snacks, which were once the preserve of nutrition-averse students.

Symington’s Mug Shot brand gained a number of new products earlier this year including Protein Pots – four flavours include Roast Chicken, Chicken Tikka, Mac & Cheese and Rogan Josh. Snacks in a mug may not once have been where consumers went for a protein boost, but these new products contain 13g of protein with less than 2% fat and fewer than 300 calories.

The company also launched Twistd, a range of protein-packed pulses, grains and seeds. “The brand appeals to hectic young professionals, culinary explorers and health-minded shoppers,” says Kevin Butterworth, marketing director at Symington’s.

And consumers are increasingly looking for healthy snacks that offer a protein portion for their children, too. Protein has joined the list of nutrients that parents are looking out for and chilled snacks are offering new alternatives to crisps and snacks.

Cheese brand Cathedral City has developed a number of formats to cater for this, including the Cathedral City Snack Bar range and Cathedral City Minis. “Consumers are becoming more mindful of the quality of calories, which means nutritious, protein-rich dairy-based snacks have become increasingly popular,” says Anca Lazar, senior brand manager of Cathedral City Snacking at Saputo Dairy.

Yet, McKechnie also underlined the continuing importance of the market of so-called “image-conscious Love Islanders” looking to bulk up at the gym. Innovation is driving this market, too. Brands such as Macro Munch and Barebells – with their heritage in

the protein powders and sports and nutrition market, respectively – deliver typically more than 20g of protein per product and have ranges of desserts, eye-catching flavours and protein drinks available to cater to the most committed exercisers.

But perhaps the clearest sign that protein has gone mainstream is the fact that Grenade – one of the first brands to emerge as the protein bar market grew – has now developed a festive limited-edition variant, a rite of passage for any FMCG brand.

“For people who are actively trying to be more health conscious during the festive season, it can be a very tempting time for snacking – the Grenade Gingerbread Carb Killa Bar lets people indulge 100% guilt-free,” says Alan Barratt, Grenade’s chief executive. Nakd is another brand to make this journey with a Christmas Pud-flavoured bar.

It’s clear that the protein and functional markets are on a journey to become relevant to customers of all kinds. Will you be ready to meet the demand when it comes?

- More: Category management