Joanna Tilley talks to suppliers and retailers to find out what trends wholesalers should be on the lookout for in the sports and energy drinks category

Soft drinks is undoubtedly one of the strongest categories in convenience and has a market value of £1.48bn. In this channel, sports and energy drink sales lead the field with 30% of total market sales.

Convenience is the natural place to sell these drinks as outlets provide shoppers with the nearest and most convenient energy fix.

When shoppers are looking for an early morning boost, they are unlikely to hunt the aisles of a supermarket for a single can. This means if wholesalers and retailers work closely together, and stock the right products, they can reap great rewards from this thriving category.

Sugar crackdown

The government’s recent crackdown on sugary drinks, alongside increasingly health-conscious consumers, has seen a shift towards sugar-free alternatives. Wholesalers need to keep track of this trend and should dedicate sufficient space for low- and zero-sugar drinks, alongside their regular core offering.

“It is imperative wholesalers offer low-calorie alternatives – meaning that a higher proportion of space in-depot is being dedicated to low-calorie products,” says Mark Bell, strategy and planning manager at Red Bull. “Diet is worth £144m, which equates to 11.3% of the sports and energy drinks category, increasing by 1.7% from last year.”

Marketing director at Barr Soft Drinks Adrian Troy says it is estimated that low- or zero-sugar energy will be worth £200m in five years. Responding to this trend, Barr Soft Drinks launched its category-boosting range, Rockstar Revolt, in 2016, and has generated sales of more than £6m since it was launched.

The taste factor

However, while consumers are looking for healthier options, they are not willing to make sacrifices on taste. This is why brands such as Monster are constantly delivering innovative flavours to the wholesale channel.

The numerous launches can present a bit of a headache, but if retailers are guided to stock the right options for their customers, it can be a great way to boost sales.

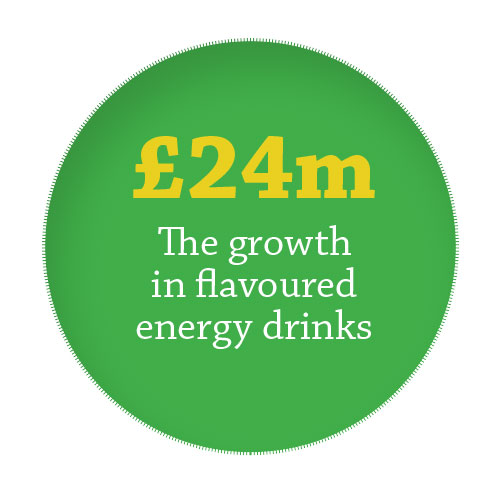

Amy Burgess, senior trade communications manager at Coca-Cola European Partners, says the importance of taste has been increasing shopper demand for more flavours in the sector.

“Flavoured energy drinks have grown by over £24m in the UK, with consumers stating that taste is the main factor when buying an energy drink,” says Burgess. “Flavour innovation in energy drinks is driving sales and enabling brands to reach new audiences.”

With its vitamin-enriched and caffeine-free credentials, it’s worth stocking Britvic’s Purdey’s. In 2017, the brand introduced its second core flavour – Purdey’s Edge, which is flavoured with dark berry juices – and it has also launched an on-the-go can format. As consumers look for healthy, free-from products, Purdey’s is a brand on the up – and over the past year, it has benefitted from penetration growth of more than 40% and value growth of 63%.

Market leaders

Monster is one of the top sellers in the energy drinks category, but in the sports drinks category, Lucozade leads the way.

Scott Meredith, sales director at Lucozade Ribena Suntory, says the energy and sports drinks aisle should mirror the big brands retailers are looking for. And ultimately, this goes back to what shoppers are looking for.

“The bulk of each segment should be made up of the biggest brands, including Lucozade Energy and Lucozade Sport,” says Meredith. “We advise wholesalers to take advantage of the full range and encourage retailers to stock up on the various SKUs. Having the right

range available to retailers in-depot helps them to drive sales in store from consumers looking for healthier soft drinks options.”

While sports and energy drinks are often consumed on the run, there is a considerable market for take-home products. Boost’s 1l line makes up 81% of take-home sales across the entire Boost range, and is also the number-one take-home stimulation SKU. “To support wholesalers by bringing customers into depots, we regularly offer promotions on bestselling products,” says Simon Gray, founder and managing director of Boost Drinks.

“For example, twice this year, we launched a brilliant deal, offering our 1l Energy Original SKU as a £1 PMP.”

Troy at Barr Soft Drinks says there is also considerable growth in this category from the popularity of the big-can format. “Big cans are driving growth at 20% with flavoured drinks playing a significant role in the success of the category,” says Troy.

Standing out

Whether wholesalers are selling individual or take-home products, it is important that merchandise stands out on shelves. Gray suggests wholesalers should use point-of-sale material to highlight products, such as creating eye-catching displays that grab the retailers’ attention.

“We always recommend wholesalers introduce posters and pallet wraps as well as making their internal promotions clear. We are happy to work closely with the wholesaler to achieve all this,” he says.

As a brand that focuses purely on the independent sector, Boost is making sure it is up to date on trends and has already reduced sugar levels in all its products. “We focused on keeping the same taste and have been out on the road at events helping to reassure retailers and discuss the changes with them,” says Gray.

“We’re also not increasing prices or changing pack sizes, so wholesalers and their customers will find that Boost energy drinks have the same quality and, very importantly, the same low price.”

Progressing through 2019, the sports and energy drinks category looks to be in good health, and will drive plenty of sales.

Retailer viewpoints

“Boost is our number- one energy drink, but that is because we push it the hardest. It is only available to independents and we hold that product in high regard and give it a prominent position in store. I think it would be useful if wholesalers reduced their ranges as 15 varieties is too confusing.”

“Our bestseller is Euro Shopper energy drink and it is selling well individually and in four-packs. I think Rockstar and Monster need to have a look at multipacks and producing smaller cans – as the government is cracking down on sugar and high energy – so they would be better doing it off their own back.”

“Own label does better in our area because of the lower price mark. From my point of view, wholesalers need to get newer flavours out quicker to convenience stores. The supermarkets always seem to get everything first and they also offer crazy deals that we cannot match.”

“Red Bull is by far our biggest seller and Lucozade Energy is also popular. People are looking for PMPs and the new Relentless Cherry at £1 is doing well. To help retailers, wholesalers could do more multi-buy promotions, such as ‘buy three for £1’ – which would work for brands such as Emerge.”

Takeaway points

1. Increase low-calorie choice – With low- or zero-sugar energy estimated to be worth £200m in five years, wholesalers need to offer a selection of low-calorie alternatives.

2. Offer variety – Growth is coming from take-home and big-can formats, so stock a selection of pack formats, and retailers can choose which is best for them.

3. Go big on promotions – Retailers are often looking for multi-buy promotions, so wholesalers can please them by making deals clear to see.

4. Be competitive – Wholesalers can help retailers if they offer them different variants and competitive prices. Convenience retailers want the same choice as multiples.

5. Stay ahead of change – There are a number of legislative changes being considered for energy and sports drinks, and wholesalers need to be aware of the policies and perhaps act first to make some of the changes.

Product news

Supplier viewpoint

strategy and planning manager, Red Bull

“Red Bull understands that space can be a big challenge for wholesalers as many look to consolidate their range. Red Bull advises operators to stock the most efficient range to drive the greatest value, while category space should be aligned with share of sales in order to maximise sales.

“Stocking the packs from the bestselling brands and sugar-free options, such as Red Bull’s Sugarfree 355ml, which continues to perform well despite flat distribution, and Red Bull Energy 250ml – the number-one single-serve soft drink, worth £137.5m and growing 3% – will help maximise sales in limited space.”