Andrew Don reports on the latest developments in tobacco and e-cigarettes at a time of seismic market change

Vaping has injected new dynamism into the tobacco market, although many retailers complain all the different products and types of technology

are confusing.

New and old-school products are must-carry lines in your depot if you want to ensure retailers do not take their business elsewhere, however.

Here are six areas in which you can ensure your business is mastering the tobacco & e-cigarettes category.

Education

Educating retailers who sell the new-wave products is key, according to Philip Morris International (PMI)’s head of sales, Matt Tisdall, who says professionally-trained wholesale staff with good understanding of e-cigs and vaping products can help ensure retailers are confident when purchasing.

Educating retailers who sell the new-wave products is key, according to Philip Morris International (PMI)’s head of sales, Matt Tisdall, who says professionally-trained wholesale staff with good understanding of e-cigs and vaping products can help ensure retailers are confident when purchasing.

“This would also ensure a better understanding of the category by retailers, helping them in facing the competitive advantage that vape stores have,” he notes.

Tisdall believes FMCG wholesalers failed to stock e-cigs early enough, which enabled vape stores to bridge the gap and establish themselves as experts in the sector.

“[Vape stores] will continue to dominate, due to their expert knowledge, what they can offer to the consumer and the amount of products they have available,” he says.

This is why training your staff to be knowledgeable about the products is absolutely critical in terms of trying to win some of that spend.

Partnerships

Imperial Tobacco has vowed to continue working closely with wholesalers through its salesforce to ensure that your independent retailer customers remain competitive relative to rival channels.

Paul Coggins, Imperial’s head of key accounts, says: “The ways in which we can collaborate include offering advice around range optimisation and space planning, plus assistance with staff training.”

Blu UK advises you to look at other retailers in the vape marketplace and understand what is working for them. Sophie Hogg, the company’s head of next-generation products, says: “For wholesalers and independent retailers, the key to winning in this category is understanding the proposition and being able to translate this into a compelling offering.”

Vapers have many different purchasing options available to them, and they will naturally buy where they feel most comfortable, she points out.

Jens Christiansen, head of marketing and public affairs at Scandinavian Tobacco Group UK, agrees. “Wholesalers know their customers better than anyone else and there will always be regional differences in product performance,” he says. “By paying attention to what customers are buying and reviewing sales data, wholesalers can see what is performing well and then stock their range accordingly.

“The simplest – but most effective –piece of advice is to stay stocked up. If a product is not in stock, customers cannot buy it, so wholesalers should make sure they monitor stock levels carefully.”

Trends

Jan Louw, head of wholesale at Japan Tobacco International (JTI) ‒ the portfolio of which includes Amber Leaf, Sterling Rolling Tobacco, Holborn Yellow, Kensitas Club and B&H Blue ‒ says it is vital to monitor trends and sales data and adapt your range accordingly to ensure retailers’ demands

Jan Louw, head of wholesale at Japan Tobacco International (JTI) ‒ the portfolio of which includes Amber Leaf, Sterling Rolling Tobacco, Holborn Yellow, Kensitas Club and B&H Blue ‒ says it is vital to monitor trends and sales data and adapt your range accordingly to ensure retailers’ demands

are met.

“With smaller packs gone, wholesalers need to adapt their tobacco room to use the additional space now available,” Louw says. “JTI will continue to work with its wholesale partners to advise on how best to use the space for both tobacco and vaping ranges.”

You should be sure to support new product launches in depot with promotions via product information leaflets and posters provided by the manufacturer, he adds.

Innovation

Innovation is certainly in no short supply. PMI, for example, is now “well advanced” in developing its MESH next-generation e-vapour product platform.

The company claims the heating technology it uses represents a new approach to the e-vapour generation.

The product uses a metallic mesh with tiny holes to heat a prefilled, presealed e-liquid cartridge that contains nicotine and flavours.

Consumers activate the heating process by pressing a button.

Unlike typical e-cigarette cartridges, MESH units are manufactured, assembled, filled and sealed in a fully automated process.

The product also features puff-activated heating and a low-liquid-level detection system that Tisdall claims ensures the consistency and quality of the vapour generated and inhaled. “These improvements address the current concerns of adult vapers in relation to quality, safety, consistency and origin,” he says.

British American Tobacco (BAT), meanwhile, is launching Vype ePen3, and has just introduced Cirro and 10Motives.

Elsewhere, Imperial’s recently launched JPS Player’s Superkings Crushball and L&B Blue Ice Crushball Superkings are testament to the continuing popularity of the capsule sector with consumers.

Blu has launched MyBlu, a ‘pod mod’ system designed to help smokers who are looking to switch to vaping, via its upcoming MyBlu Intense Liquidpods range. The products contain Nicotine Salts, and they target experienced vapers seeking a powerful, yet discreet, secondary device.

Tradition

There is still a strong market for traditional tobacco products. Ritmeester Mini Moods, for example, has shown “incredible growth” since May last year as consumers have looked for a filtered product that comes in an “affordable” 10-pack, says Tony Lyles, the company’s field development manager.

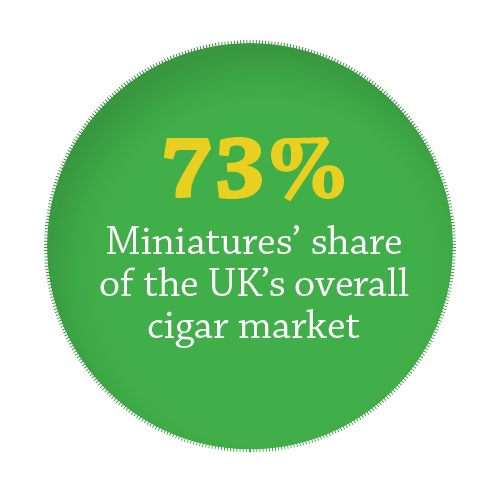

He points out that Ritmeester’s pricemarked Royal Dutch Miniature Blues cigarillos (£4.79) continue to “steal” from the more traditional brands. “Of all cigars sold in the UK, 73% are of the miniature variety,” Lyles says.

“We live in a time-poor environment and have to smoke outside, which leaves little room for cigars that can take up to 30 minutes to smoke.”

Imperial has recently ‘reimagined’ its Rizla papers packaging; every pack now features a ‘tuck-in’ closing mechanism designed to reduce waste, plus a ‘soft-touch finish designed to make the packaging more tactile.

The manufacturer’s Gold Leaf JPS Handy Pack continues to be a strong seller in roll-your-own for 30g tobacco, along with 80 Rizla Regular Green rolling papers and 72 ultra-slim mentholated tips, Coggins adds.

Elsewhere, JTI’s Kensitas Club is the fastest-growing tobacco brand in Scotland, according to Nielsen Market Track (April 2018), following the relaunch of the heritage Scottish brand in January, which saw the original range updated with a lower RRP of £8 in response to the growing trend towards ‘ultra value’ brands. JTI also added Superkings to the line-up.

Legislation

The tobacco category continues to get to grips with legislative change. Hot on the heels of standardised packaging and tobacco display restrictions comes track and trace, part of the European Union Tobacco Products Directive II regulations, which comes into force on 20 May next year.

Imperial’s Coggins describes it as “a significant logistical challenge” that requires tobacco manufacturers to apply coding to all tobacco product packaging including the pack, outer, master case and pallet so that it can be tracked from manufacturer all the way to retailer.

“Our wholesale partners will need to ensure they have both their systems and staffing aligned to be able to manage this new process,” he says.

“We will be working closely with all customers in order to ensure they are fully aware of the legislation and the changes they will need to accommodate to ensure full compliance in time for the deadline date.”

Retailer viewpoints

“I do not understand the e-cigs market and I do not think there is enough support in it. I would like wholesalers to help us with understanding the market a bit better, and I would like more support from manufacturers. We just need more clarity. I know some people do well in it. We do not.”

“The main reason I buy from Booker is that I get delivered to regularly so I know that I am going to get the stock on a regular basis and it is fed into my EPoS system as well. I find what I need, when I want it. I have got a good availability on cigarettes.”

“The thing that differentiates e-cigarettes as a market is that it is an immature market. There are an awful lot of players in the game, so if they can give guidance as to what the right products to stock are, that will help. Traditional cigarettes are fairly straightforward to manage and have got easier since 10s dropped out.”

“There have been a few wholesalers that I have dealt with who have been massively helpful in educating our staff and explaining what the customer is looking for when it comes to vaping. Support from the wholesalers in this area is a really big bonus for us. In the other side of the other market, price determines where we source our cigarettes from, along with availability of key brands.”

Product news

Read similar: Boost your e-cigarette sales