Charlotte Buxton explores the key soft drinks trends affecting the category, and how wholesalers should respond

The £2.6bn convenience soft drinks category continues to be one of the most profitable for retailers and wholesalers. However, with the sugar levy now in force and consumers becoming increasingly health-conscious, retailers need guidance from wholesalers about how to get their soft drinks offer right.

Adrian Troy, marketing director at Barr soft drinks, says: “The needs of shoppers are continually evolving, and shopper behaviours fluctuate, but the convenience sector remains resilient and, as a result, looking at trends and behaviours relating to soft drinks is key to continued success.”

The soft drinks industry levy has been in place for well over a year now, and health remains a top priority for many shoppers. An additional 11 million litres of lower-sugar soft drinks are being consumed every week, according to Simon Gray, founder and managing director of Boost Drinks. Healthier options are proving particularly popular with young people, so wholesalers should help retailers market these products to this audience.

Gray says: “We know our sugar-free varieties are particularly popular with the younger generation because of their increasing health agenda.

“We also know that low sugar content is the most important factor among 18- to 30-year-olds when choosing a soft drink, with 86% of young people believing that sugar is bad for their health. This emphasises the importance of retailers catering to a more health-conscious generation.”

Health trends

Health trends

Greater consideration of the health benefits of drinks is driving the appeal of the market. The functional juices segment has grown by 52%, according to Caroline Wilding, Tropicana marketing manager at PepsiCo. “Breakfast is a key time for chilled fruit juice, but there is a significant opportunity for growth at other times of the day, with nearly half of all juice enjoyed after breakfast,” she says. “For the impulse channel, in which smaller fruit juice formats are more popular and convenient, we offer 250ml and 300ml bottles of our Tropicana range.”

Another section of the chiller that is doing well is flavoured milk drinks, which James Logan, commercial director at Refresco UK, explains has grown by four million litres in the independent channel in the past year. Innovations such as alternative milk brand M+LKPlus’s ‘grab and go’ Salted Honeycomb Hazelnut and Strawberry Cheesecake Cashew flavour nut milks are answering demand for health-focused options.

Healthier consumer behaviour doesn’t stop at reduced sugar intake. It’s been well documented in the press that young people are drinking much less alcohol than older generations, with many going teetotal. Wholesalers are advised to stock up on premium alternatives to ensure that non-drinkers have exciting options to turn to.

Andrew Turner, director of wine at Halewood Wines & Spirits, adds: “As many as one in five people – one in three of those under 24 years old – are choosing not to drink because of the increased awareness of the health risks associated with alcohol, but teetotal consumers still want premium soft drinks at home and when socialising.”

Neil Lunn, UK trade marketing manager for Supermalt, agrees. “We have found that many consumers are looking to trade up from the most common soft drinks to try something different, which they perceive as a more premium product. This trend, and the increase in the accessibility of premium soft drinks, give wholesalers the chance to grow sales while tempting a wider customer base to their business,” he says.

Premiumisation

Whether catering to drinkers or non-drinkers, premium mixers are proving an essential part of any soft drinks offer. Amy Burgess, senior trade communications manager at Coca-Cola European Partners (CCEP), explains that the growing demand for premium spirits continues to increase the popularity of premium mixers on-premise and off-trade, as consumers seek to recreate premium, quality mixed drinks at home.

- Read more: Barr Soft Drinks adds to low-calorie range

“Consumers are drinking less, but drinking better, and are prepared to pay more for an indulgent beverage, with over half of consumers saying they would prefer a smaller quantity of a premium dark spirit than a larger quantity of a standard one,” she says.

Energy drinks

The energy category continues to play a significant role in the soft drinks offer, growing at 11% year on year, while in convenience stores, nearly one in two drink-now products bought is an energy drink, and big-can flavoured energy is driving this growth, so giving this subcategory the right amount of space on shelf is crucial.

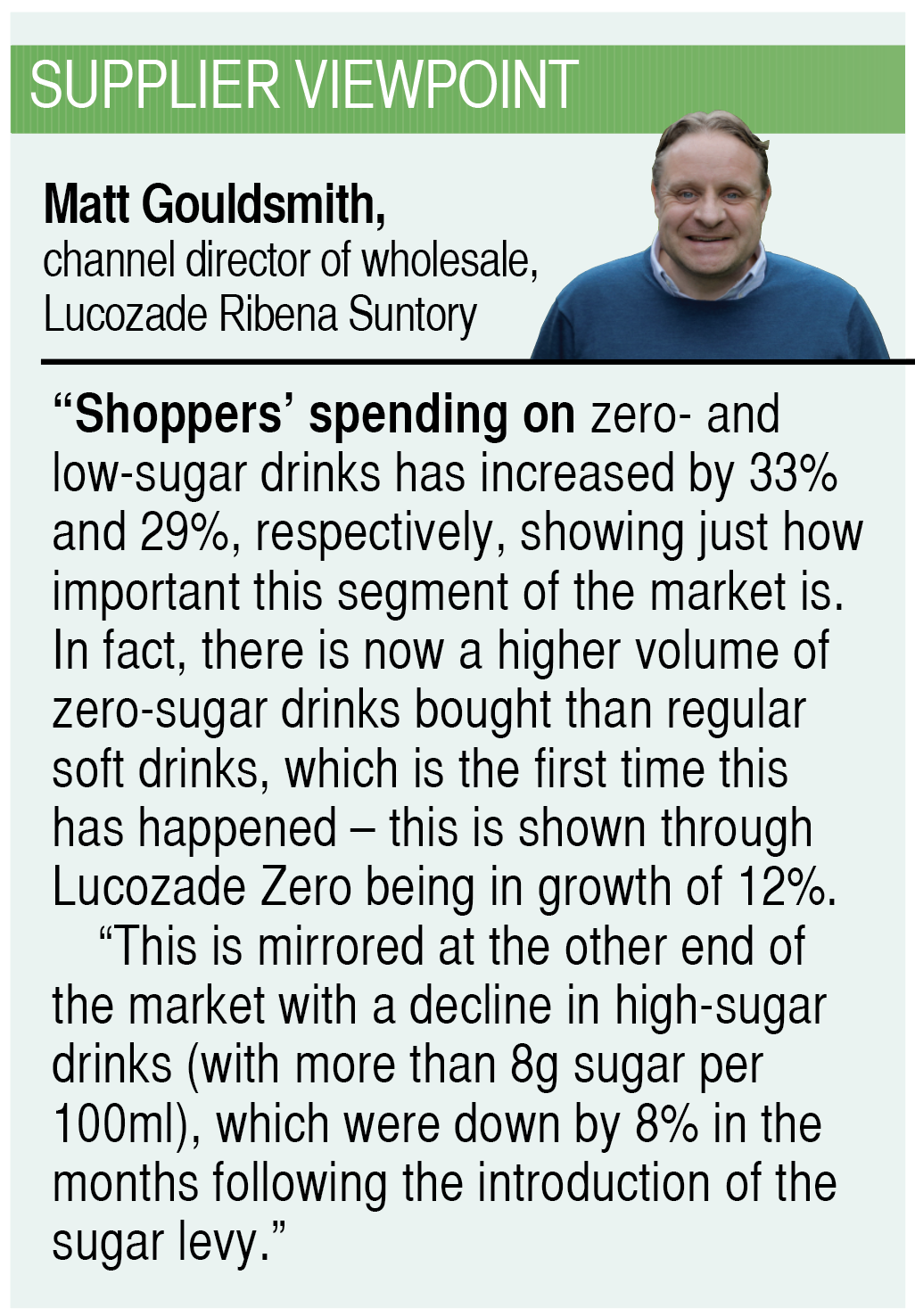

The introduction of exciting flavours is attracting new customers into the sector. Lucozade Ribena Suntory’s (LRS) Matt Gouldsmith says the brand’s flavours range has already contributed £72m-worth of sales to the energy category, showing how important it is for retailers to carry a diverse selection of flavours in their chillers. Red Bull is also tapping into the growing flavoured energy market with the launch of its Red Bull Coconut Berry Edition.

Creativity

As the soft drinks sector becomes more complex with continual innovation from brands, wholesalers have an important role to play in helping their customers create a coherent offer tailored to their audiences.

“Wholesalers have the opportunity to offer a variety of different soft drinks options to tempt different market sectors,” says Marja Lawrence, operations manager for Funnybones Foodservice.

“Publicans might be looking to buy coconut water as a mixer for cocktails, for example, and retailers will have a variety of customers who are looking for alternatives to sweet and fizzy drinks, while cafés may want more healthy drink options. Now is the time to help and explain to customers by segregating soft drinks into different types – squashes, waters, juices and smoothies, healthy options, sports and energy drinks, mixers and so on.”

Wholesalers are encouraged to be creative with displays and to offer tastings to customers to generate interest in unusual offerings.

Lawrence says: “Recipes are useful, too. Display seasonal ideas for mocktails, cocktails, smoothies and soft drink mixes, which will encourage uptake during different times of the year.”

Beyond the need to meet customer demand for a compelling variety of soft drinks, wholesalers also need to consider how they can make more environmentally friendly choices, with sustainability now at the forefront of consumers’ minds.

This is just one of many challenges in this hugely profitable and important category.