PRIYANKA JETHWA looks at how Britvic is working to ensure that it is prepared for the incoming ‘sugar tax’, as well as how it is preparing wholesalers for the levy’s arrival.

April 2018 is a date on every soft drinks’ wholesaler’s mind, as it marks the month the soft drinks industry levy – also known as the ‘sugar tax’ – comes into play. While many may dread the impact it could impose on their business model, Trystan Farnworth, commercial director for convenience & impulse at Britvic, has the solutions at hand.

At the recent Better Wholesaling Summit, where Britvic was the headline partner, Farnworth spoke to wholesalers and suppliers alike on the ways they could minimise the impact the sugar levy could bring to their businesses, and what Britvic was doing as one of the UK’s largest soft drink manufactures to help accommodate wholesalers as the legislation passes. Some of the slides from that presentation accompany this article.

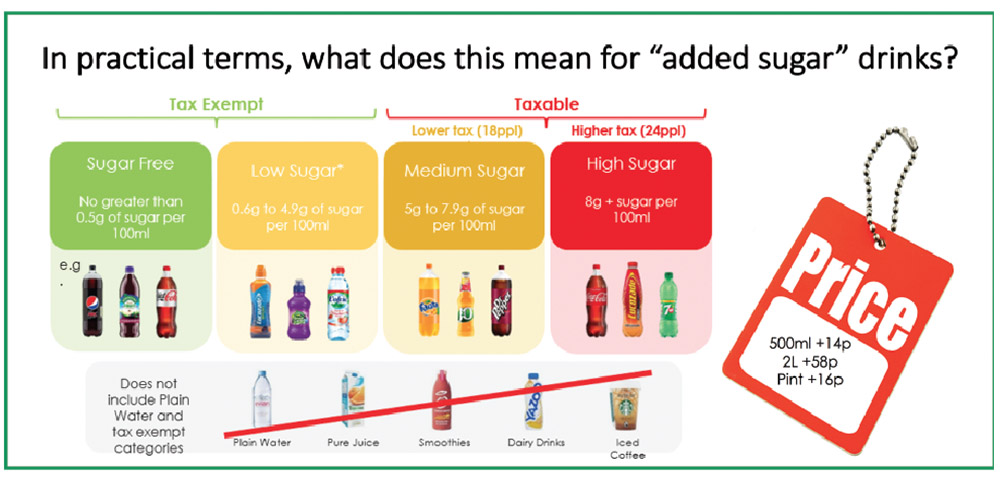

But, first, what does the sugar levy actually mean for wholesalers, and who is it actually going to affect? The levy is a UK government-led initiative, which will make soft drink manufacturers pay a specific tax on drinks that contain 5g or more added sugar per 100ml. There will also be a higher charge for drinks that contain 8g or more added sugar per 100ml. Excluded from the tax will be pure fruit juices, smoothies, iced coffee and dairy drinks that have a high milk content.

As for the rationale behind the move, the UK government points to the fact that the UK has one of the highest obesity rates among developed countries, and it’s getting worse. It predicts that by 2050, over 35% of boys and 20% of girls aged between six and 10 are expected to be considered obese. In addition, the estimated obesity-related cost to the NHS is over £6bn. Farnworth emphasises this, adding: “When children enter primary school, one in 10 are obese. By the time they leave school, one in five are obese.”

So why is it that only soft drinks have been targeted, and not candy and other high-sugar goods? “The soft drinks category is much easier to reformulate compared to, say, confectionery, plus it has a much younger buyer profile than other FMCG categories. So you can see why soft drinks was a relatively easy decision,” Farnworth explains.

So why is it that only soft drinks have been targeted, and not candy and other high-sugar goods? “The soft drinks category is much easier to reformulate compared to, say, confectionery, plus it has a much younger buyer profile than other FMCG categories. So you can see why soft drinks was a relatively easy decision,” Farnworth explains.

Pulling out the positives

Data from research body Him shows that soft drinks remain the number-one footfall driver to depots, with the most recent data confirming that soft drinks purchases are the number-one reason as to why people go to convenience stores, having overtaken products like tobacco, news, milk, confectionery and bread.

Thus, the intent behind the levy is twofold. Farnworth explains: “Firstly, it is to encourage the manufacturers to reformulate drinks, and secondly, it’s about passing the price on. Despite it being an industry, manufacturer levy, the costs will be passed on by suppliers to wholesalers and to retailers, who we expect will ultimately pass it onto shoppers. Therefore, the aim is that if consumers want to choose a drink that contains more added sugar, they’ll have to pay more for it – this way, it will encourage a lower sugar consumption.”

To get a sense of what this means for costs in wholesale compared to other trades, Farnworth says: “In very practical terms, the price of a 500ml bottle of regular Pepsi or Coca Cola might approximately increase by 14p; in wholesale, a 2lt bottle would increase by 58p; and, a pint of cola in a pub would increase by 16p.”

But it’s not all doom and gloom. Britvic has been working on the reformulation of its drinks for a long time, as playing a proactive role in helping to address obesity has been an integral part of its strategy since 2012. Therefore, to ensure wholesalers are equipped for the levy’s introduction, Britvic has vowed that by the time the sugar tax arrives, 95% of the brands it owns in the UK will be immune from the levy.

[…] Advertorial: How is Britvic preparing for the incoming ‘sugar tax’? http://www.betterwholesaling.com/britvic-sugar-tax/ […]