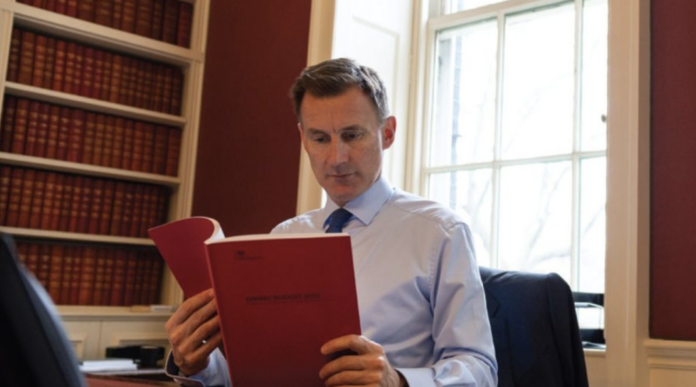

The FWD has revealed its concern at Chancellor of the Exchequer’ Jeremy Hunt’s recent autumn statement, with the trade organisation feeling that little support has been made available for the wholesale channel.

“It will concern a lot of wholesalers. With inflation at 4.6% and food price inflation at 10.1%, little support has been made available for a vital sector which is tasked with keeping the nation fed,” said chief executive James Bielby.

The FWD shared its opinion in the following key areas:

National Living Wage: Against the context of increasing costs in every single discipline and no further financial support from the Treasury, wholesalers will need to find space within budgets to contend with the single biggest rise in the National Living Wage. This is a very challenging requirement.

On Business Rates: We welcome further business rates support for organisations but it’s unclear if the wholesale sector will be eligible for support. There is no retail, hospitality, or leisure without supply from wholesale, and yet the Treasury seems unable to grasp the full value of our sector.

On Public Sector Food : By requiring the public sector to operate within the constraints of the Autumn Statement, this essentially means that inflation will need to be absorbed. This will result in reduced budgets for public sector food, which will be to the detriment of both wholesalers and the vulnerable people being fed in education, hospital, and care settings.

On Alcohol and tobacco Duty: We welcome the freeze in alcohol duty until 01/08/24. But increases in rates will have implications for the illicit market and its knock-on effects for revenue lost by the Exchequer. The government should focus resources on enforcement activity to remove criminals from trading in illicit and non-duty paid goods.

Apprenticeships: We appreciate the Government’s commitment to advancing apprenticeships by earmarking £50 million to stimulate training in growth sectors and overcome barriers to entry in high-value apprenticeships. But it’s imperative that the Government addresses the challenges associated with the current levy. Our members contribute hundreds of millions of pounds into the pot but since the levy only allows funds to be spent in an overly restricted way, wholesalers cannot use the money to fund any relevant courses – effectively rendering it a tax on businesses. To encourage greater investment in training businesses need increased flexibility in allocating funds to train staff.

Net Zero: We welcome the announcements to allocate £4.5 billion to bolster British manufacturers on their path to net zero. The diverse funding package is instrumental in supporting the decarbonisation of businesses. But it’s evident that we need a more comprehensive approach which considers infrastructure, skills and provides long-term clarity to business through roadmaps and strategies. The commitment of FWD and its members to achieving net zero targets by 2040 remains resolute; nevertheless, realising this ambitious goal requires stronger and more strategic support from the Government.