Joanna Tilley finds out suppliers are not resting on their laurels when it comes to the biscuits and cakes category, which continues to come up with innovative new concepts

With shoppers increasingly looking for tasty and convenient snacks on the go, the biscuits and cakes category will not be crumbling any time soon. In line with the UK’s love for a sweet treat, brands such as Mr Kipling, Cadbury and McVitie’s are continuing to fire out innovative NPD and special offers to wholesalers.

Despite health consciousness growing in many sectors, word on the ground from independent retailers is that indulgent biscuits are as popular as ever. With contributed sales of £2.1bn from sweet biscuits in 2018, Stuart Graham, customer marketing director at Pladis, says there will always be a place in Britain’s hearts for treats. Nevertheless, health is still a trend that suppliers, wholesalers and retailers should be keeping an eye on.

On the move

What is undeniable is that on-the-go formats in all food categories are booming and this has led to the growth of snack-packs and individual packs of cakes and biscuits.

What is undeniable is that on-the-go formats in all food categories are booming and this has led to the growth of snack-packs and individual packs of cakes and biscuits.

Even if it means overpaying for a product, many consumers are only thinking about their next meal and want something they can eat straight away or when they get to the office.

In response to this trend, Steve Kelly, channel director at Premier Foods, says the company is continuing to innovate to offer balanced treats and handy pack formats. “Products with twin packs and individual portions are available across the Premier Foods range, enabling the wholesale and convenience channel to offer trusted products in practical formats,” he explains.

Border Biscuits’ 180g snack packs also offers a strong option for shoppers who plan to eat on the hop, says the company’s marketing manager, Suzie Carlaw. She adds: “Our twin mini packs contain biscuits that are versatile to put in a handbag, briefcase or lunchbox and keep you going throughout the day, whether as part of a meal or simply as a sweet treat.”

Paying a premium

Premiumisation is another trend Carlaw is noticing in the sector, and advises wholesalers to stock a range of high-quality and versatile products. While financial uncertainty around Brexit has resulted in some consumers shunning expensive nights out at fancy bars and restaurants, it hasn’t stopped people spending money on what they deem quality food.

“We’re going to continue to see a rise in complex or eye-catching cake designs as consumers want cakes that look as good as they taste,” says Gary Mullineux, purchasing director at foodservice group Caterforce. “This feeds into the need for ‘Instagram-worthy’ desserts that will help to entice people.”

Social media and Instagram are also handy tools for wholesalers who can use merchandising displays and PoS in their warehouse to gain traction with followers and retailers online.

However, to prove the cakes taste as good as they look, Matthew Grenter, sales manager at Brioche Pasquier, suggests wholesalers allow customers to sample them in store.

If the product looks the part, and tastes the part, it will be very difficult for retailers to walk away without making a purchase.

Limited-edition cakes and biscuits are also successful for many brands because they provide a point of difference and a little excitement. “We regularly release limited-edition ranges to acknowledge changes to consumer interest and habits throughout the year, notably around popular seasons and high-profile events,” says Steve Kelly from Premier Foods.

Tried and tested

Core ranges still make up the vast majority of sales, though. What can boost these brands even further is using price-marked packs – something that gives customers confidence they are not being overcharged.

Graham believes that by having a core range of household name brands for retail customers – such as McVitie’s Milk Chocolate Digestives – wholesalers can ensure independent retailers are stocked up and driving sales forward.

“To boost their core range sales, we recommend wholesalers stock new innovations and high-performing products from trusted brands,” says Caroline Mitchell, Mrs Crimble’s brand controller at Wessanen.

Mitchell says the business works closely with wholesalers to develop solutions that meet their needs with the best range possible.

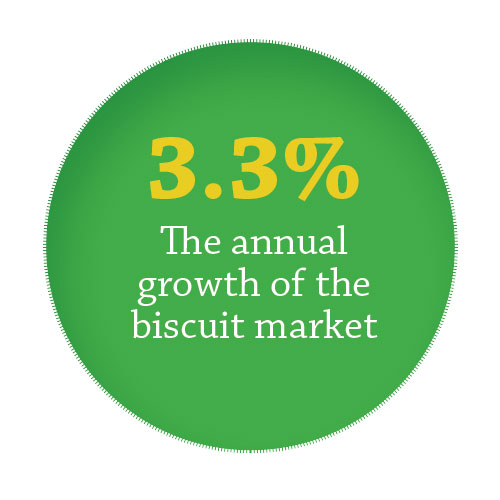

Another biscuit brand on the up is German Food company Bahlsen, which is often recognised for its premium products. Julien Lacrampe, trade marketing manager at Bahlsen, says that while the biscuit market is growing at 3.3% year on year, Bahlsen is outstripping that at an impressive 16.3%.

“The trend of looking for more indulgence when selecting a biscuit is evident in the performance of Choco Leibniz, which outperforms in the special treats category,” says Lacrampe. “Choco Leibniz is now the largest brand in special treats, while many other brands are in decline.”

Healthier options

While treat biscuits remain undoubtedly popular among shoppers, there is a growing opportunity for wholesalers and retailers to increase sales if they can also get their healthier proposition right.

While treat biscuits remain undoubtedly popular among shoppers, there is a growing opportunity for wholesalers and retailers to increase sales if they can also get their healthier proposition right.

Susan Nash, trade communications manager at Mondelez International, says research shows that the health-conscious consumer is on the rise, with 85% of consumers admitting they are trying to improve some of their diet to become healthier.

To capitalise on this trend, Ritz Original cracker and Ritz Original Breaks launched a new recipe with 70% less saturated fat last September, alongside Ritz Cheese crackers, which launched with 50% less saturated fat.

In order to mirror this change in eating habits, Premier Foods has engaged with Public Health England’s Sugar Reduction Programme and is investing in reducing sugar without compromising taste. “Alongside that, we have introduced calorie caps and were one of the first companies to include colour-coded front-of-pack labeling, helping shoppers make an informed choice regarding their sugar, fat, saturated fat, salt and calorie intake,” says Kelly.

As well as a focus on fat and calories, there is also bigger demand for free-from products. New companies are entering this thriving market and it is likely established brands will introduce more gluten- and dairy-free alternatives over the coming years.

Retailer viewpoints

“With people looking for value, our own-label brands, Euro Shopper and Happy Shopper, are doing well. I don’t see a demand for healthy eating in this category – we have a protein range and Graze boxes for these shoppers.”

“Jaffa cakes are our star seller at the moment. Price-marked at £1, they provide good value for money, it’s a nice product and maybe some people consider them slightly healthier than the alternatives. Booker are great at offering a good selection and giving value to the retailer. In this category, I don’t think product positioning is as important as other sectors, as people will find things themselves.”

“In terms of biscuits, Fox’s, McVitie’s and Cadbury chocolate-coated biscuits are doing well – we premium-price some of those. The McVitie’s team often visits the store with various offers. Our wholesalers are doing a good job and there is nothing to complain about.”

“Digestives, Maryland Cookies and Oreo biscuits sell well. Despite the healthy-eating trend, I have not noticed any decline in treat biscuits. Bestway have got offers on biscuits and I feel they tend to have quite a lot of promotions. However, there are less on the cake side.”

Product news

Takeaway points

1. Stock price-marked packs – Maximise sales by stocking PMPs from the big brands that demonstrate good value for money to retailers.

2. Keep it seasonal – Seasonal editions generate new interest in the category and appeal to new buyers. They should be stocked close to the main event.

3. Concentrate on portable formats – Snack and individual packs will make the most of the food-to-go trend.

4. Point of sale – Signpost best-selling brands using eye-catching point of sale, making it easy for retailers to search.

5. A wide variety – To engage as many customers as possible, stock a large range of biscuits and cakes that includes budget, premium, healthy and indulgent options.

Hi there,

Is shipping to Barbados possible?

Please confirm and also if you accept credit VISA or MASTERCARD for payment or QuickBooks Ach for an international order,And if i can arrange pick up from your store/warehouse by private freight company.

Regards,

Robert Aaron

Ashop Supply

845 475 8723