Toby Hill takes a bird’s-eye look at hot beverage trends, drawing out key lessons for wholesalers seeking to make the most of sales through the cold months to come

As the UK tips into the year’s dark half, the nation’s love affair with hot beverages is flaring back into vivid life. But despite tea-drinking being steeped in British heritage, it is by no means a category that remains untouched by the broader trends that are shaping food and drink sales around the globe.

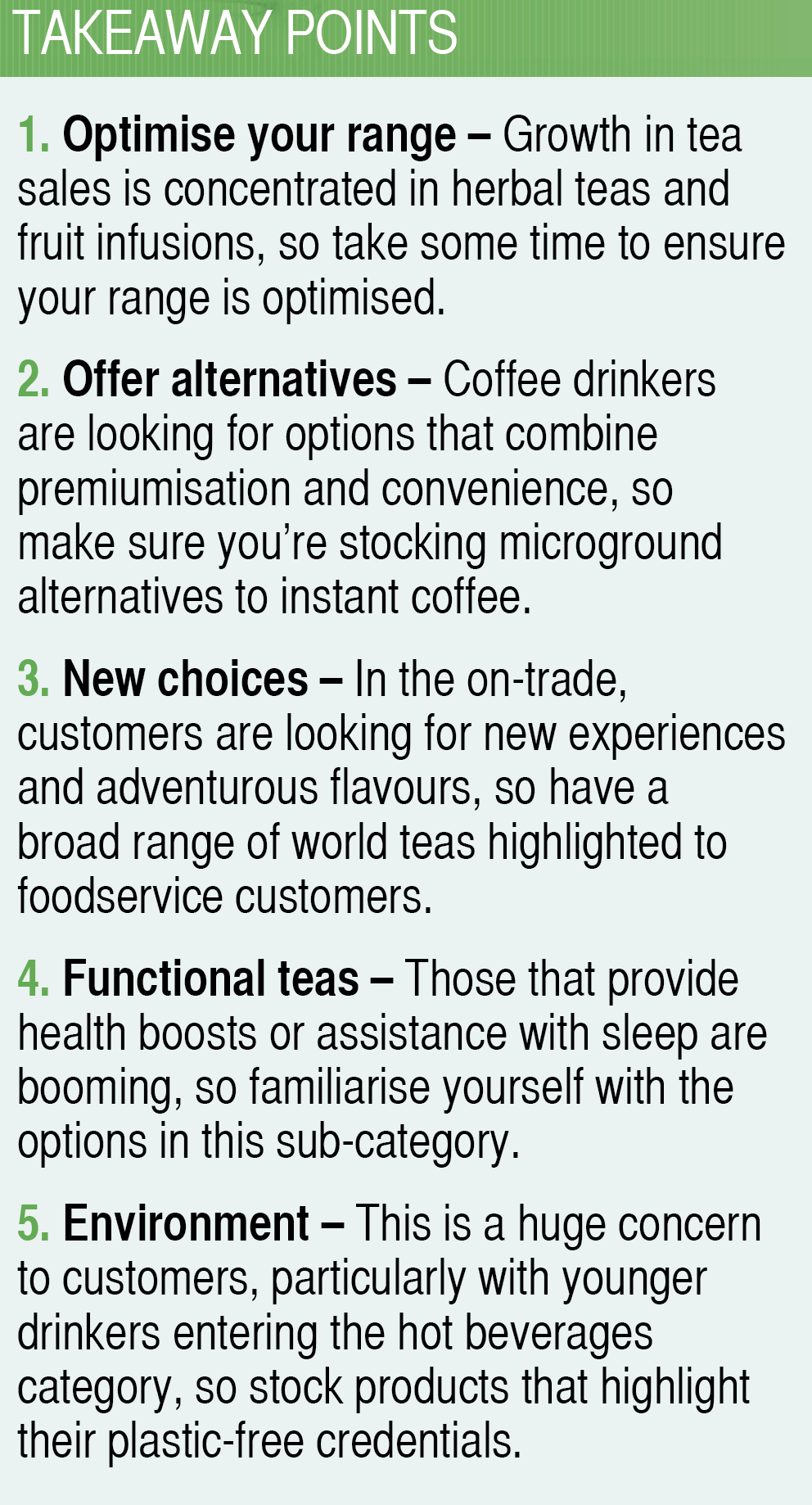

Within the UK, black tea remains by far the biggest seller, accounting for 85% of the total category, according to PG Tips brand owner Unilever. But key growth areas within the category are found elsewhere: in herbal teas and fruit infusions, and in functional blends that offer benefits such as immune boosts or assistance with falling asleep.

Similarly, coffee drinkers continue to seek out new and exciting options to enliven their morning routines – as well as increasingly choosing dairy-free alternatives to milk.

Healthier drinking

Trends towards healthier consumption are reshaping buying habits across food and drink, and hot beverages are no exception. A desire for fresher, more natural products has provided a significant boost for sales of green teas and herbal infusions, while some manufacturers have developed new lines focused on specific health benefits.

“Alternatives to standard black teas have really started to grow in recent years,” notes Louise Cheadle, co-founder of Teapigs. “The growth of our herbal infusions and green teas has shown that consumers are moving towards healthy, natural products – especially younger tea drinkers.”

Such health priorities have inspired some customers to turn away from their traditional morning coffee, Cheadle adds, providing a further boost to herbal alternatives.

“There’s increased concern around caffeine intake, and when cafés or restaurants offer a good range of teas and infusions, this often leads tea to be the go-to option for many customers,” she says.

Over at Tetley, product innovation has also focused on harnessing health trends, with the firm recently launching its Super Tea Envelope brand into foodservice. The range is composed of three flavours, each one boasting a specific health benefit, such as Vitamin B6 or Vitamin C. The firm has also developed Tetley Decaf Sleep Easy, a blend of decaffeinated black tea with lemon balm, lavender and vanilla, formulated to help deliver a restful night’s sleep.

Finally, it’s not just teas and infusions that are being impacted by health trends. Even treat products such as hot chocolate are having to change to stay with the times, with Mondelez recently launching a reduced-sugar version of Cadbury Hot Chocolate into the market.

“This latest innovation will allow retailers to tap into the ongoing consumer trend of sugar reduction by offering Cadbury Hot Chocolate with 30% less sugar,” says Susan Nash, trade communications manager at Mondelez International.

Retailer Viewpoints

“We’ve seen a big increase in sales of chilled coffees, cans of Starbucks iced coffee or Monster Espresso. We also sell ready-to-drink hot coffee, but as there are a lot of cafés near us, we have to compete on price by marking them up and charging £1.20. We recently introduced a 20p saving if you bring your own reusable cup and people like that.”

“I notice that people aren’t drinking as much black tea as they used to. But we’re seeing sales of green teas and other herbal teas, like peppermint and lemon & ginger, increase instead, particularly Twinings teas. Coffee still sells well, especially iced coffees from the chiller, like chilled cans of Starbucks and Costa Coffee.”

“We haven’t seen much change in our sales recently. Instant coffee is a good seller, Nescafé is always popular. We’ve started stocking Nescafé Gold cappuccino sachets and they’re flying off the shelf. Sales of herbal and green teas tick along, they’re definitely worth stocking, but we haven’t observed any

“I notice that people aren’t drinking as much black tea as they used to. But we’re seeing sales of green teas and other herbal teas, like peppermint and lemon & ginger, increase instead, particularly Twinings teas. Coffee still sells well, especially iced coffees from the chiller, like chilled cans of Starbucks and Costa Coffee.”

Caffeine-fuelled premiumisation

While health trends may be moving some drinkers towards herbal teas instead of caffeine,

British coffee culture remains massive. Within the coffee sub-category, the key driver of buying habits is premiumisation, according to Martyn Bell, category marketing manager at Jacobs Douwe Egberts.

“Coffee shop trends are leading both out-of-home and at-home consumption,” Bell says. “Despite a demand from shoppers for more premium coffee types, such as pods, many retailers are failing to stock these.”

Bell gives the specific example of microground coffees – premium instant coffees that combine the taste of ground with the convenience of instant.

“With the demand for premium coffee and specialities growing fast, there’s opportunity to develop more space to these segments. However, with only 32% of convenience stores stocking microground coffee such as Millicano and only 16% stocking Kenco Specialities, supply is not there to meet the demand,” Bell says.

“There is a real opportunity for wholesalers to communicate to retailers on such under-stocked products and encourage consumers to trade up within their coffee purchases.”

Adventures in the on-trade

Adventures in the on-trade

These same trends – healthier consumption and premiumisation – are also major factors in the on-trade, as well as retail. As a result, offering options such as reduced-sugar and dairy-free alternatives is essential for many cafés and restaurants.

“Consumers are becoming increasingly aware of health and nutrition – factors that are deeply embedded into the UK coffee market,” says Tom Gray, buyer at wholesale distributor Beacon. “By including healthy milk alternatives such as almond and soya milk, free-from and non-dairy options, operators will be able to reach a wider demographic and increase sales.”

Alongside healthier options, customers are increasingly looking for refreshing alternatives to traditional coffee, Gray adds.

“Thirty per cent of consumers say that an iced blended coffee is their favourite option, according to our supplier Matthew Algie,” he notes.

Another trend reported by on-trade suppliers is demand for more diverse and adventurous options.

“When it comes to hot drinks menus, consumer needs are constantly evolving – it’s no longer just about offering basic hot chocolates, coffees and teas – and now consumers expect to see on-trend flavours and premium ingredients across everything they consume,” says Lee Hyde, beverage innovation manager at Monin. This company has a range of more than 150 flavoured syrups for imbuing coffee with a diversity of flavours, he adds.

Finally, Tetley brand manager Michelle Jee outlines similar trends within on-trade tea consumption – particularly in terms of customers looking for different flavours.

“Out-of-home hot beverage consumers are becoming progressively more adventurous in their choice of flavours and blends,” she says.

“Combined, green and matcha tea accumulate 21% of favourite non-black tea blends out of home, reflecting consumer demand for new flavours and blends.”

Going plastic-free

A final consideration that manufacturers are increasingly factoring into their product design is growing environmental awareness among their customers. Such concerns were super-charged by recent episodes of Blue Planet, where David Attenborough solemnly narrated the immense damage done to ocean ecosystems by single-use plastic.

As a result, there is a growing movement towards eliminating plastic from products wherever possible. Teapigs has led the field on this front, becoming the first tea company to receive the plastic-free trust mark from Plastic Planet.

Similarly, Clipper manufacturer Wessanen UK has also ensured its tea bags are plastic-free, with the material made from a species of banana and the tea bag envelopes fully recyclable.

Bryan Martins, marketing and category director at Wessanen UK, outlines some tips for wholesalers keen to stay in touch with these trends.

“Check your tea bags don’t contain any plastic or use plastic to seal,” he advises. “Check the packaging is recyclable, biodegradable or compostable. And ask your supplier where they source their tea.”

Supplier Viewpoint

“Grab your customers’ attention. Thought needs to be given to how to bring attention to the different products available. Not doing so risks high-value products going unnoticed because of poor layout. “Also think about tea and consider how your mix of teas can fit with different occasions: breakfast, mid-morning power boost, lunchtime cleanse, teatime treat, healthy lifestyles, or wind-me-down. You also need to dedicate an area to out of home and create a dedicated space in-depot for the growing area of foodservice tea sales. Furthermore, offering price-marked packs will give your retail customers added value.”

Tetley’s Heather Bushell on the out-of-home opportunities for tea

Tetley’s Heather Bushell on the out-of-home opportunities for tea