Tom Gockelen-Kozlowski finds out why price-marked packs (PMPs) continue to thrive in convenience, and what the best approach for them is in order to achieve a profitable depot

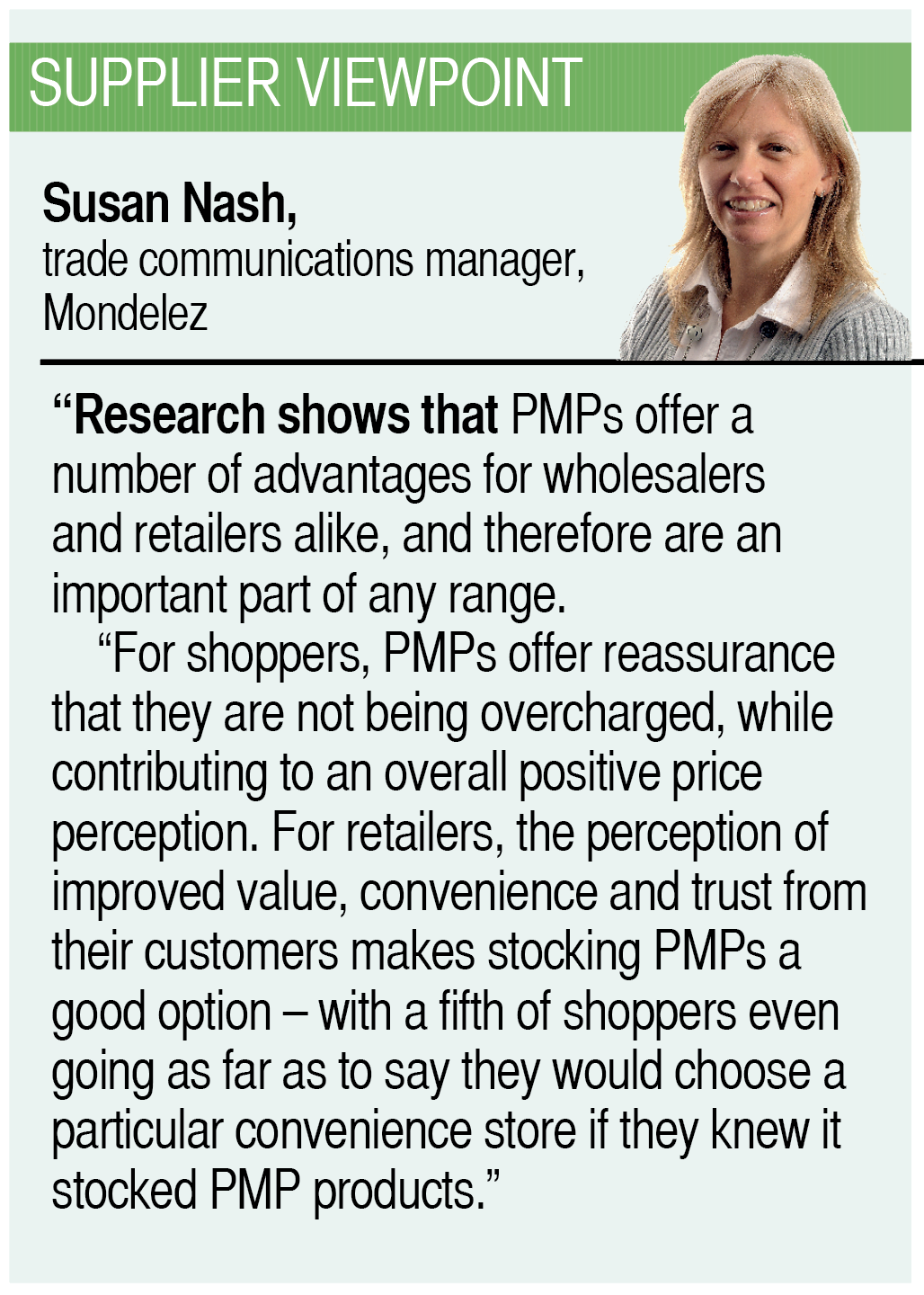

Price-marked packs (PMPs) continue to flourish because of one simple fact: they work. “We know price-marked soft drinks are growing more quickly, with 16% growth compared to 6% from non-PMPs,” says Matt Goldsmith, channel director at Lucozade Ribena Suntory.

Isabel Lydell, at Burton’s Biscuits, agrees: “The market for PMPs remains hugely important in driving the impulse sector. Many shoppers look to PMPs as reassurance of value, with PMPs of bestselling brands meeting this demand.”

Isabel Lydell, at Burton’s Biscuits, agrees: “The market for PMPs remains hugely important in driving the impulse sector. Many shoppers look to PMPs as reassurance of value, with PMPs of bestselling brands meeting this demand.”

But if the traditional model is still where you see the role of PMPs in stores, then there’s a lot of catching up to do.

NPD

Firstly, PMPs have become vital in the market when introducing new products. Mars Wrigley, Mondelez and Lucozade have all recently launched products using PMPs to help attract first-time shoppers.

Lucozade Energy’s Watermelon & Strawberry Cooler, for example, is price-marked, Goldsmith says, to “encourage shoppers to try the new flavour”.

And here’s the thing: these PMPs often offer better margins, meaning that unlike in decades past, they’re popular with retailers.

Interestingly, PMPs are also starting to drive the format of some product development. Calbee’s crisps brand Seabrook has recently launched two new £1 PMPs, on a 6x25g multipack and an 80g impulse sharing bag.

Jon Wood, commercial director of Calbee UK, says: “These larger bags support the impulse market because its £1 PMP gives shoppers another reason to grab it on the way to a party or stock up for a night with friends.”

Calbee has also reduced case sizes on its 31.8g packs to help retailers reduce stockholding and improve cashflow, with the move designed to help wholesalers, too.

Calbee’s new products join the ruling class of PMPs: the £1 pricepoint. Whether it’s a chocolate tab bar, a sharing bag or drink, retailers consistently report that a £1 PMP is enough to drive sales. Meanwhile, KP Snacks has launched McCoy’s Thai Sweet Chicken and Muchos Nacho Cheese plus Wheat Crunchies Crispy Bacon and Pom-Bear (two for £1) all at this popular price.

Growth

“The £1 PMP range is growing in value at 19.1% versus non-PMP formats,” says Matt Collins, trading director at the company. “With KP Snacks growing ahead of the market in £1 PMPs, we are in the perfect position to drive overall category growth.”

KP Snacks isn’t alone in using PMPs to boost sales of its bestselling core brands. Burton’s Biscuits’ Lydell says: “Offering customers a range of price-marked biscuits is a simple, cost-effective way to attract impulse shoppers – and increase basket spend.”

Wagon Wheels, Jammie Dodgers and Maryland Cookies are now all available in PMPs, with new on-the-go formats also supported with price-marks. Elsewhere, the fact that the full range of Red Bull products, Mondelez’s core count lines, tablet and sharing bag formats, and PepsiCo’s Walkers grab bags, have PMPs shows that no brand is too grand to use them to grab shoppers’ attention.

Another major brand to embrace PMPs to help drive sales of its core range is Mars Wrigley. The company’s customer excellence director, Jo Alvarado, says: “In order to raise sales and capitalise on early consumer demand, it’s vital that wholesalers champion new products in depot. Last summer, Mars Wrigley introduced new PMPs across Skittles (55g) and

Starburst (45g).”

Such is the importance that suppliers now put on PMPs, they are now keen to spread the message wherever possible. Amy Burgess, senior trade communications manager at Coca-Cola European Partners (CCEP), says: “Our dedicated sales team works closely alongside wholesalers to help them unlock the best opportunities for sales growth, and to develop a better understanding of our ranges. This relationship enables us to inform wholesalers about the role of PMPs, as well as the importance of choice.”

The reference to choice is worth dwelling on – almost all major suppliers make a point of offering both price-marked and non-price-marked versions of their main products.

Yet it’s worth noting that even CCEP’s limited-edition seasonal product, the Halloween-themed Fanta Dark Orange, will carry a PMP this year – a product that’s made to drive impulse sales using a PMP to further drive its, well, impulse sales.

Retailer viewpoints

“These days, we always look for PMPs – customers can often prefer a price-mark, even if the non-PMP is cheaper. Bisto’s frozen meals just gained a PMP at £1.69, whereas previously we had sold it at £1.39. We buy it in for about £1. So, that 30p rise in margin really helps.”

“These days, we always look for PMPs – customers can often prefer a price-mark, even if the non-PMP is cheaper. Bisto’s frozen meals just gained a PMP at £1.69, whereas previously we had sold it at £1.39. We buy it in for about £1. So, that 30p rise in margin really helps.”

Meten Lakhani, St Mary’s Supermarket, Southampton

“Confectionery is a category where you have a choice whether to stock PMPs, but the price difference can be ridiculous. To get the same margin on a 50p PMP bar, a non-PMP has to be at 80p. In contrast, cut-price soft drinks have lower margins and drive lower spend.”

“Confectionery is a category where you have a choice whether to stock PMPs, but the price difference can be ridiculous. To get the same margin on a 50p PMP bar, a non-PMP has to be at 80p. In contrast, cut-price soft drinks have lower margins and drive lower spend.”

Kay Patel, Best-one, Stratford, east London

“Price-marks on premium products are a sign of the times. I’m on the KP Snacks forum and we were discussing the arrival of PMPs for Kettle Chips and, I haven’t seen them yet, but I expect Tyrell’s PMPs soon, too. I’d sell them because you can sell pretty much anything with a £1 price-mark.”

“Price-marks on premium products are a sign of the times. I’m on the KP Snacks forum and we were discussing the arrival of PMPs for Kettle Chips and, I haven’t seen them yet, but I expect Tyrell’s PMPs soon, too. I’d sell them because you can sell pretty much anything with a £1 price-mark.”

Harj Gill, Select & Save The Windmill, Rubery, Birmingham

“Margins are getting better and PMPs are enticing to customers, so we have to have them on pretty much everything now. With spirits, prices were getting so high – we have PMPs on fractionals, 70cl and 1l bottles on brands like Glen’s, Smirnoff and Jack Daniel’s. It can be £3 to £4 difference in price.”

“Margins are getting better and PMPs are enticing to customers, so we have to have them on pretty much everything now. With spirits, prices were getting so high – we have PMPs on fractionals, 70cl and 1l bottles on brands like Glen’s, Smirnoff and Jack Daniel’s. It can be £3 to £4 difference in price.”

Nishi Patel, Londis Bexley Park, Kent

Economical insecurity

While the effectiveness of price-marking is no doubt a major reason behind its current ubiquity, it’s worth focusing on the context behind the rise of the PMP. One of the most obvious causes is the decade of economic insecurity the UK has suffered, something which began in 2008 and has continued during the post-referendum years of uncertainty caused by Brexit.

According to Monisha Singh, shopper marketing manager at Kepak, “price sensitivity shown by shoppers is set to continue” and this has informed not only the decision to continue to use PMPs, but also how to price Kepak’s marquee Rustlers brand.

“That’s why our PMPs are available at accessible prices, helping attract new customers and encouraging repeat purchase from brand loyalists and impulse shoppers,” she says.

For context, the Rustlers All Day Breakfast Sausage Muffin has a £1.50 PMP, compared to the McDonald’s equivalent at £2.79.

Yet, while PMPs can be associated with offering a value proposition to retailers, they are also being used by brands to reach a price-conscious customer base reluctant to compromise on quality. This demanding part of the market is one that has grown fast as Lidl and Aldi have begun to win over middle-class shoppers across the UK.

Shah Khan, senior marketing manager of restaurant-quality frozen food company Aviko, says PMPs are a strategy that can stop a race to the bottom in the independent channel.

“Many wholesalers and retailers could be missing out on incremental sales by stocking too many low-value chip brands and not dedicating enough space to other frozen potato products that are driving growth in the category.

So, with the likes of super-premium Kettle Chips now also embracing the PMP, it is clear that those in the industry who once said certain areas of the market would be immune from its lure now need to think again. The PMP is, and will remain, a staple of the FMCG sector, with plenty of opportunity to be had.

- More: Category management