Optimism and reflection was the order of the day as the Federation of Wholesale Distributors’ annual conference returned for the first time since 2019.

Over 300 wholesalers and suppliers were in attendance at St. Georges Park in Burton-Upon-Trent at a time in which the industry is still feeling the effects of the Covid-19 pandemic and Brexit, with recent transport and distribution issues putting the industry under enormous pressure.

Here are ten things we learnt at the conference:

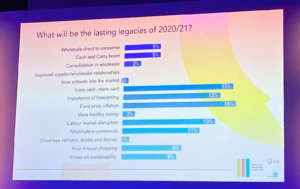

1. Food price inflation and the move to card payments are the lasting legacies of Covid

Following FWD chief executive James Bielby’s opening address in which he paid tribute to an industry that has gone through an unprecedented 18 months, he revealed the results of an industry-wide survey which cited food price inflation and the evolution of card payments as the lasting legacies of the past year and a half. Unsurprisingly there wasn’t a single vote for ‘improved

Following FWD chief executive James Bielby’s opening address in which he paid tribute to an industry that has gone through an unprecedented 18 months, he revealed the results of an industry-wide survey which cited food price inflation and the evolution of card payments as the lasting legacies of the past year and a half. Unsurprisingly there wasn’t a single vote for ‘improved

supplier/wholesaler relationships’, which face to face meetings should start to correct as we head into a more normalised , non-Covid landscape.

Read more: FWD slams Government over HGV crisis

2. There is a mixed outlook for the economy

Roger Martin-Fagg was in the East Midlands to bring the wholesale industry an economical update. The behavioural economist explained the effects of the Covid pandemic and made a prediction that inflation is expected to rise around 4.5%, with wage growth up 6%. He also expects real GDP to be at 3.5% and house prices to be up by 5% by the start of 2023. Fagg also stated that policy rate of interest will rise to 0.75% by end of 2022 and long run rate of interest will rise from 1 to 1.5% over the same timeframe.

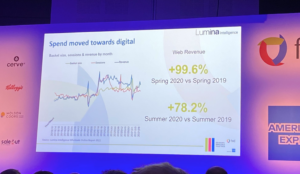

3. Digital’s influence in wholesale continues to grow

Lumina Inteliigence’s Blonnie Walsh highlighted the huge growth in digital over the Covid-19 period across the industry. Although digital’s influence was already gaining traction pre-Covid, the pandemic accelerated this at a huge pace with the insight director explaining how web revenue increased by 99.6% in Spring 2020 compared to the same period in 2019. Summer 2020 also witnessed a 78.2% increase compared to its 2019 equivalent.

Lumina Inteliigence’s Blonnie Walsh highlighted the huge growth in digital over the Covid-19 period across the industry. Although digital’s influence was already gaining traction pre-Covid, the pandemic accelerated this at a huge pace with the insight director explaining how web revenue increased by 99.6% in Spring 2020 compared to the same period in 2019. Summer 2020 also witnessed a 78.2% increase compared to its 2019 equivalent.

4. There are three key shortcomings the channel needs to address

Mirakl’s partner sales manager Samuel Igbinadalor, meanwhile, shared three business model shortcomings wholesalers need to fix as we head into a digitally-led future. These included outdated & rigid buying processes, warehouse limitations which restrict assortment, as well as costly and inflexible logistics. He revealed that 44% of wholesale organisations rank driver shortages, labour costs and capacity crunch as the biggest challenges to supply chains.

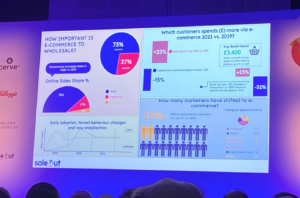

5. E-commerce in wholesale has now stabilised

SalesOut Marcus Vallance believes e-commerce in wholesale has now stabilised after forced behavioural changes led to a huge uplift. Meanwhile, Julian Owen explained how an e-commerce strategy is now critical to driving growth within Turner Price, with the Hull-based wholesaler more than tripling its product base since moving its focus to e-commerce.

behavioural changes led to a huge uplift. Meanwhile, Julian Owen explained how an e-commerce strategy is now critical to driving growth within Turner Price, with the Hull-based wholesaler more than tripling its product base since moving its focus to e-commerce.

6. Sugro is moving towards a less traditional model

Sugro is now moving towards a more diverse strategy, with its managing director Neil Turton explaining how the buying group is miving away from its traditional sole focus on impulse categories. Head of trading & marketing Yulia Godwin then revealed Sugro’s digital growth since the last FWD conference following its partnership with b2b.store. This has led to 30-50% of sales now coming via the app so far in 2021.

Sugro is now moving towards a more diverse strategy, with its managing director Neil Turton explaining how the buying group is miving away from its traditional sole focus on impulse categories. Head of trading & marketing Yulia Godwin then revealed Sugro’s digital growth since the last FWD conference following its partnership with b2b.store. This has led to 30-50% of sales now coming via the app so far in 2021.

7. The industry isn’t out of the woods yet

Unitas managing director John Kinney still believes that the wholesale industry is facing a huge number of challenges. Product, wage and energy inflation, ongoing supply issues, D2C, changing consumer behaviours, legislation (DRS, HFSS, ULEZ etc., and consumer confidence in OOH are just a few of the tests the channel looks set to face over the next year.

8. Wholesale is still a forgotten channel in the wider public consciousness

Public and political consciousness of the food supply chain remains focused on the big players and not wholesale, said Brakes’ Hugo Mahoney, with the FWD adding that it hopes this will change in the near future now that wholesale’s role has ever been more visible to both the public and the Government. Mahoney also pointed out the importance of the foodservice supply chain working together, calling it a ‘moral imperative due to the work within critical institutions’. He also projected the UK foodservice industry to grow at more than 3% over the next half decade.

Public and political consciousness of the food supply chain remains focused on the big players and not wholesale, said Brakes’ Hugo Mahoney, with the FWD adding that it hopes this will change in the near future now that wholesale’s role has ever been more visible to both the public and the Government. Mahoney also pointed out the importance of the foodservice supply chain working together, calling it a ‘moral imperative due to the work within critical institutions’. He also projected the UK foodservice industry to grow at more than 3% over the next half decade.

9. Gender equality is still a problem

Elit Rowland of Women in Wholesale pointed to a recent survey from the organisation which revealed 28% of women working in the industry feel a lack of respect, 20% see a lack or opportunities, and 44% believing that career development is the main area of their job that they need support with. Improvements from the research include a drop in gender  discrimination in the workplace, with women who said they had experienced issues decreasing from 57% in 2019 to 36% in 2021.

discrimination in the workplace, with women who said they had experienced issues decreasing from 57% in 2019 to 36% in 2021.

10. Wholesale’s role in the healthy eating trend still unclear

Founder of TWC, Tanya Pepin offered her predictions for the future of healthy eating, but is still unclear as to where wholesale sits within this. She believes that over the next five years sustainability, wellness and ethical choices will be central to purchasing decisions and that the multiples will quickly adapt to meeting these emerging trends, but is still unsure whether wholesalers will be part of the ‘healthier mix.’