The first four months of 2023 have seen an increase in the volume of M&A activity in the food and beverage industry compared to the same period in the prior year (up 17.9%).

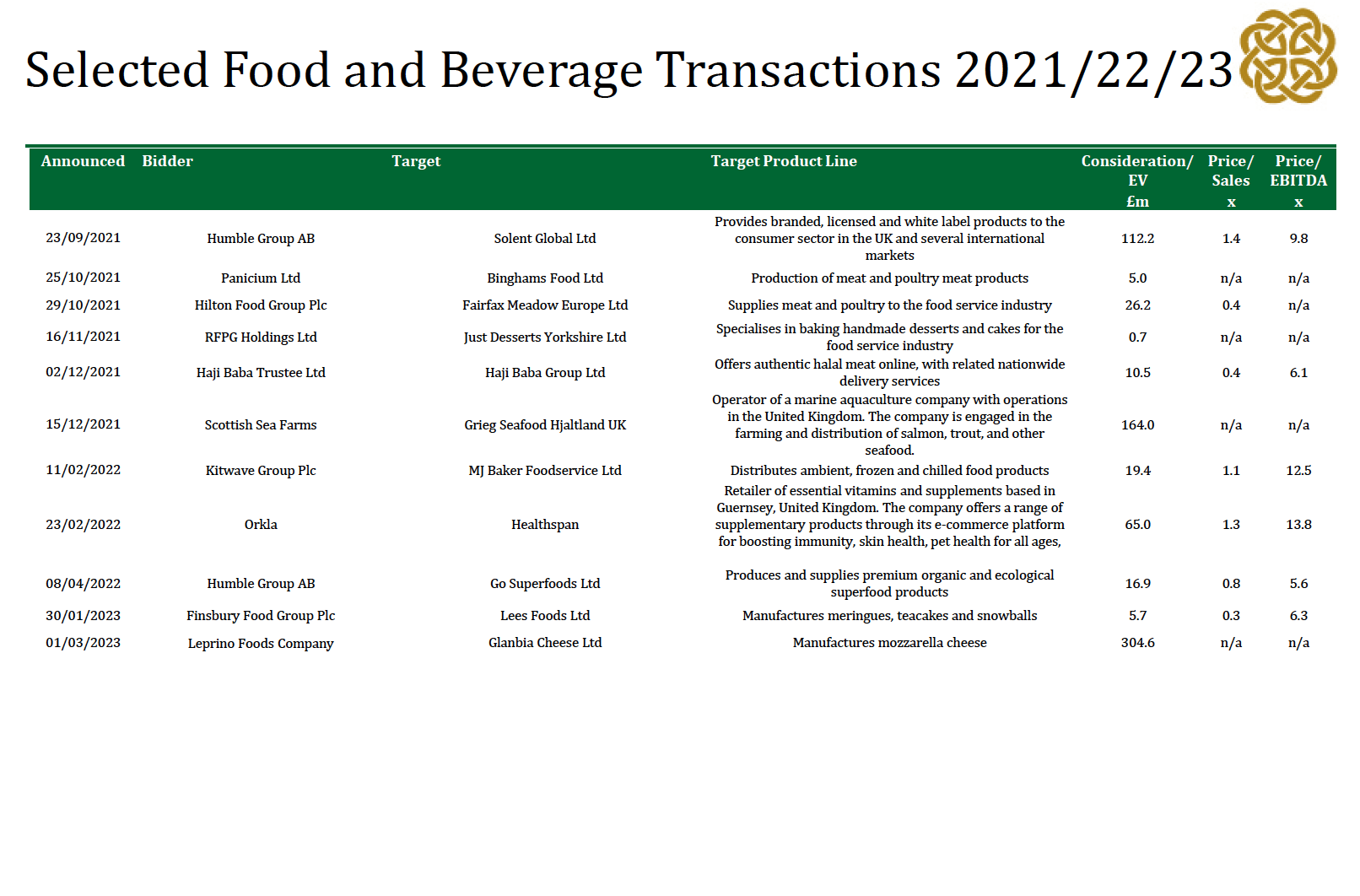

Research from advisory firm Oghma Partners shows that deal value has increased by 60.3% (c. £450.0m), however, excluding the Glanbia Cheese transaction (EV of £304.6m) deal value actually declined.

Over 80% of deals had an estimated value of £10m or less as there was a significant absence of middle to higher market deals during the period. Only 6% of transactions were above the £50.0m mark, falling well below the five-year historic average of 12.5%.

Read more: Food and beverage M&A deals drop 90% in value

Mark Lynch, partner at Oghma Partners, said: “This year’s opening Tertial has highlighted the resilient and defensive characteristics of the food and beverage M&A sector with T1 deal volume at its highest level since 2017 despite the relentless market challenges.

“However, deal value continues to be particularly low compared with the historic average and persistent macroeconomic headwinds continue to be a major culprit: inflation remains stubbornly high forcing further interest rate hikes and increasing the cost of debt, a cost-of-living crisis has reduced consumer spending, geopolitical tensions have increased market uncertainty and supply chain issues have piled more pressure on the industry. These factors have manufactured a significantly less favourable environment for larger transactions with 81.8% of deals having an estimated enterprise value of less than £10.0m,” he added.

“Looking forward, we expect deal volume to show a sustained recovery with carve-outs forecast to be an increasingly common divestment option as larger corporations look to trim their balance sheets amongst the economic uncertainty and to sell underperforming or non-core assets.